Personal Income Tax

W-2 income

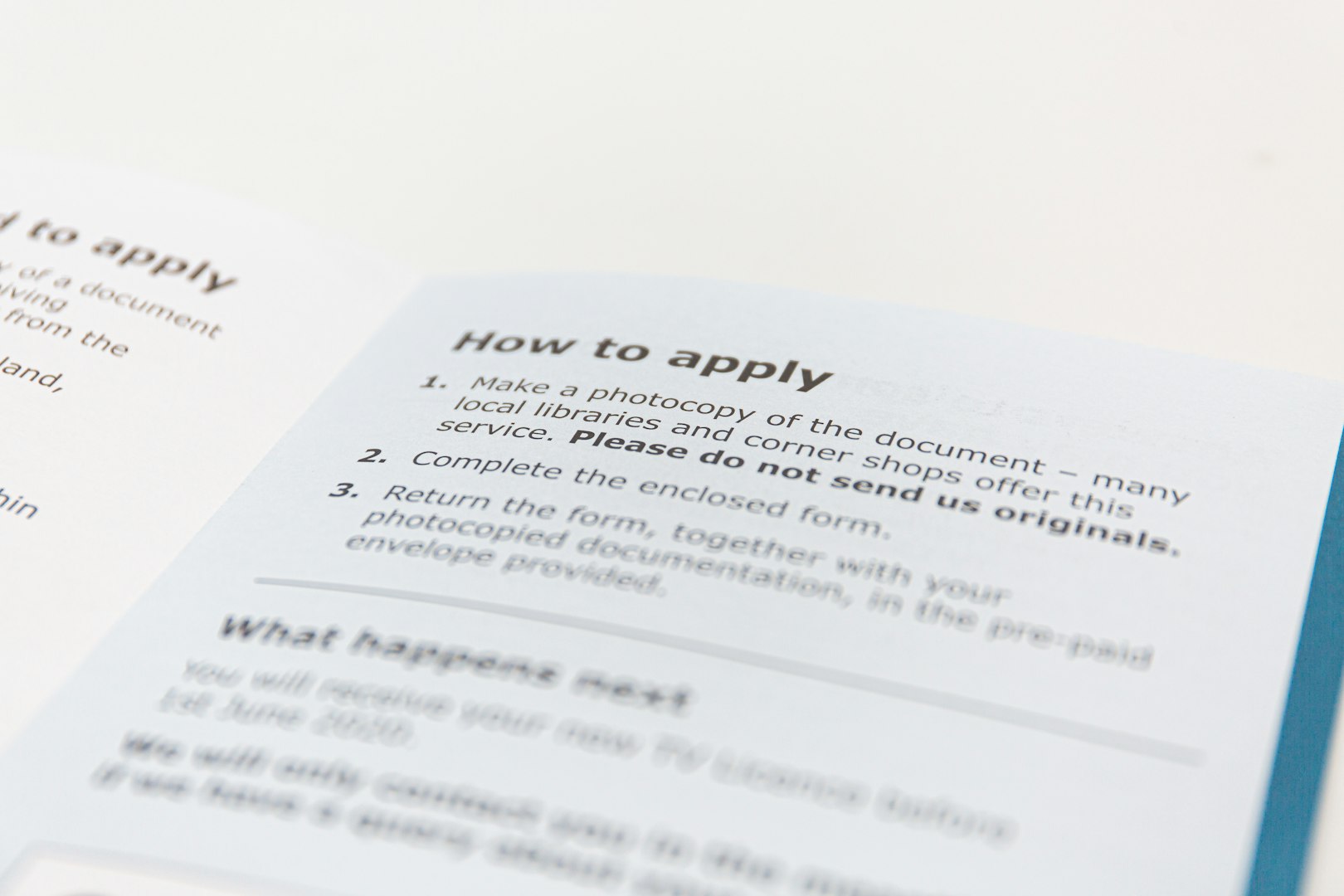

ITIN Application

Interest or dividends (1099-INT/1099-DIV)

IRS standard deduction

Earned Income Tax Credit (EITC)

Child Tax Credit (CTC)

Student loan interest deduction

Itemized deductions claimed on Schedule A

Unemployment income reported on a 1099G

Business or 1099-NEC income

Stock sales (including crypto investments)

Rental property income

Credits, deductions and income reported on other forms or schedules